With young, growing populations and strong GDP expansion forecast, Africa and the Middle East share an acute need for mobile connectivity. This means significant organic and inorganic growth opportunities for our business.

Our Africa and the Middle East markets at a glance

+46m

increase in population(1)

+79m

more mobile connections(2)

+30k

new PoS requirement(2)

The demographic dividend

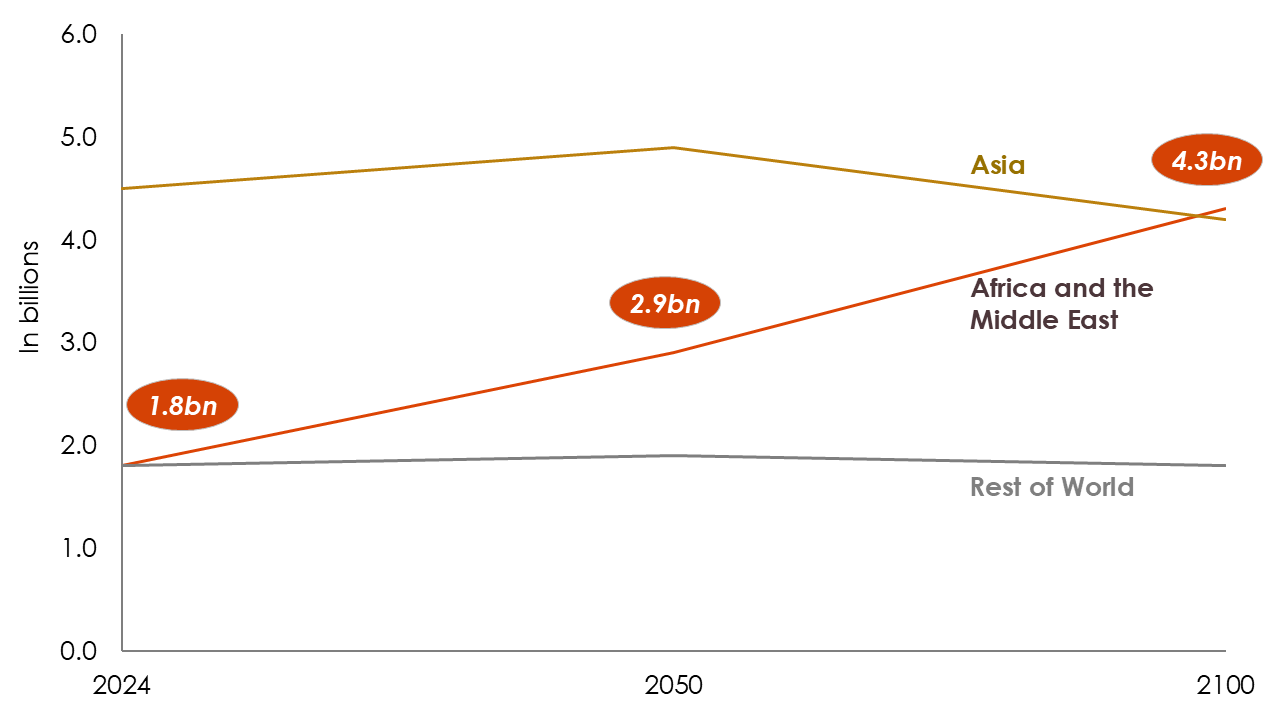

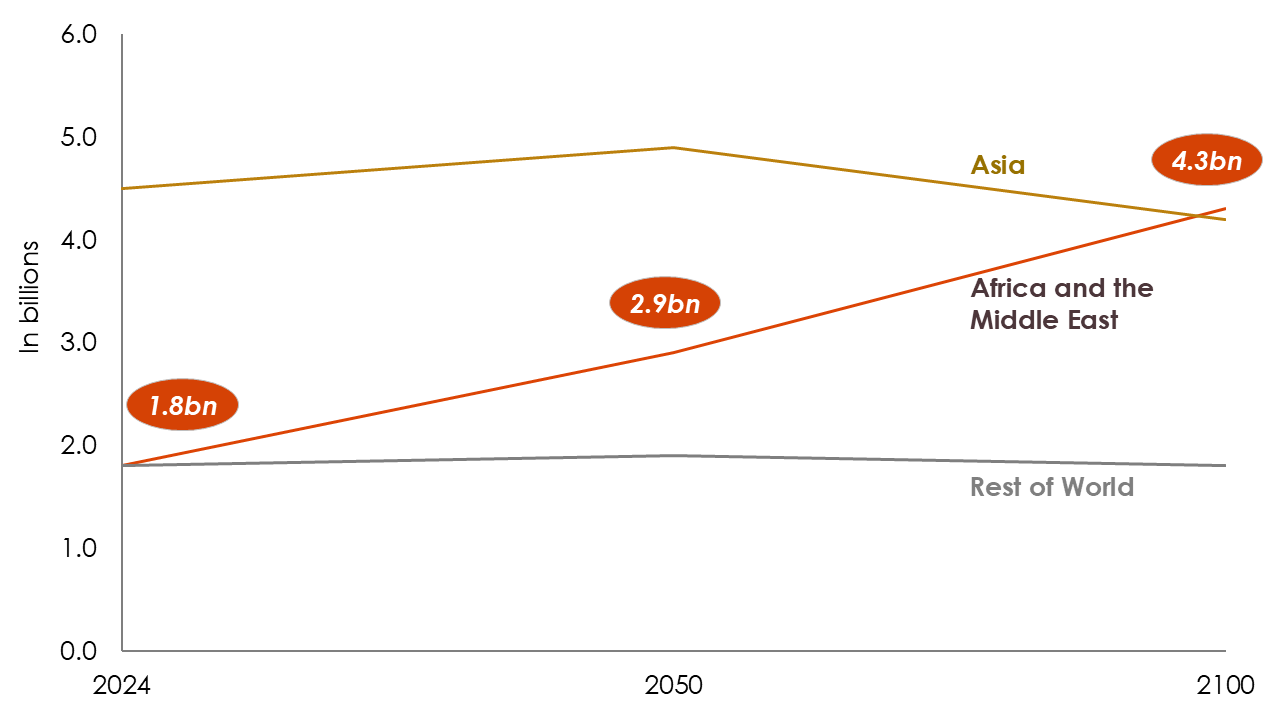

Across this century, population growth in Africa and the Middle East will far outstrip any other region. By 2100 the region will be the most populous globally, and its working-age population is expected to triple over the next 30 years. Accordingly, there will be huge demand for mobile infrastructure over the coming years to support this growth.

Population forecast(3)

Leading positions in attractive markets

Our markets share similar growth characteristics: strong GDP growth, a young and urbanising population and increasing smartphone adoption. Combined, these factors are expected to drive an estimated requirement of over 30,000 points of service (‘PoS’) in our markets over the next five years. Each PoS represents a potential new tenancy for our business and this organic growth opportunity exceeds the size of our portfolio today.

As the leading independent tower company in seven of our nine markets, this positions us well to support mobile operators’ network expansion, through leasing-up on our existing site portfolio or developing new build-to-suit sites.

Shifting up the technology curve

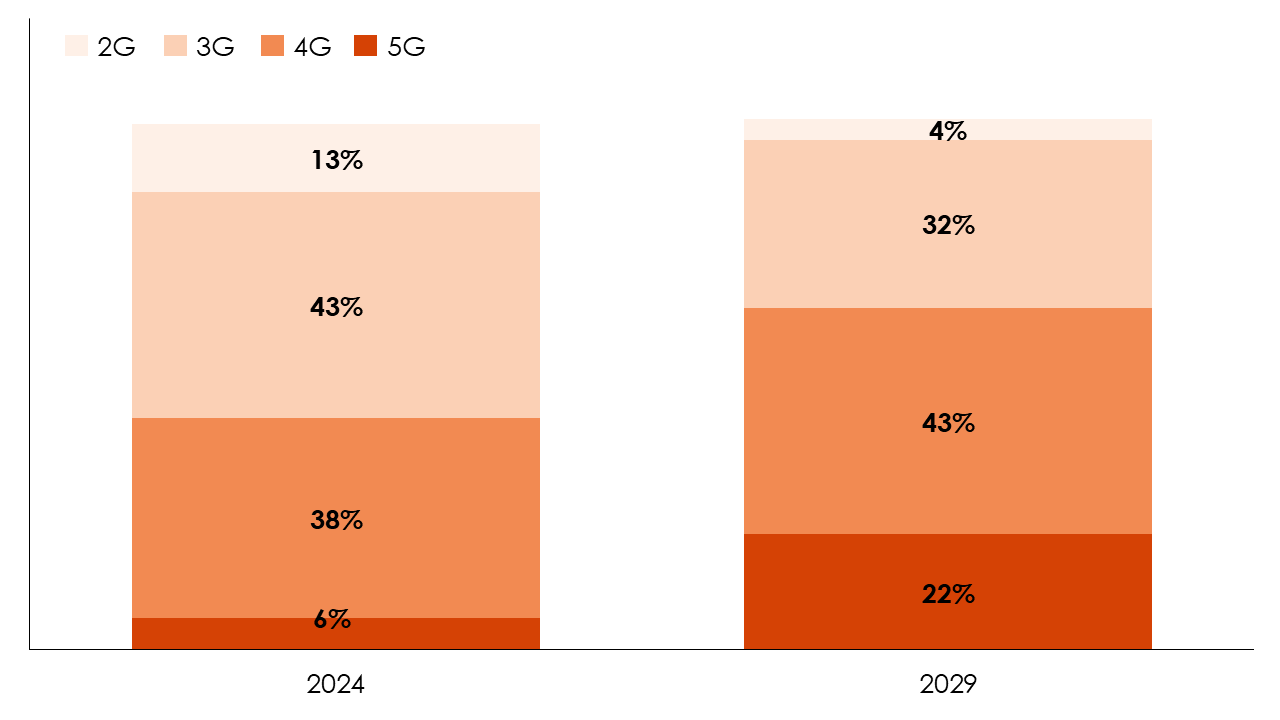

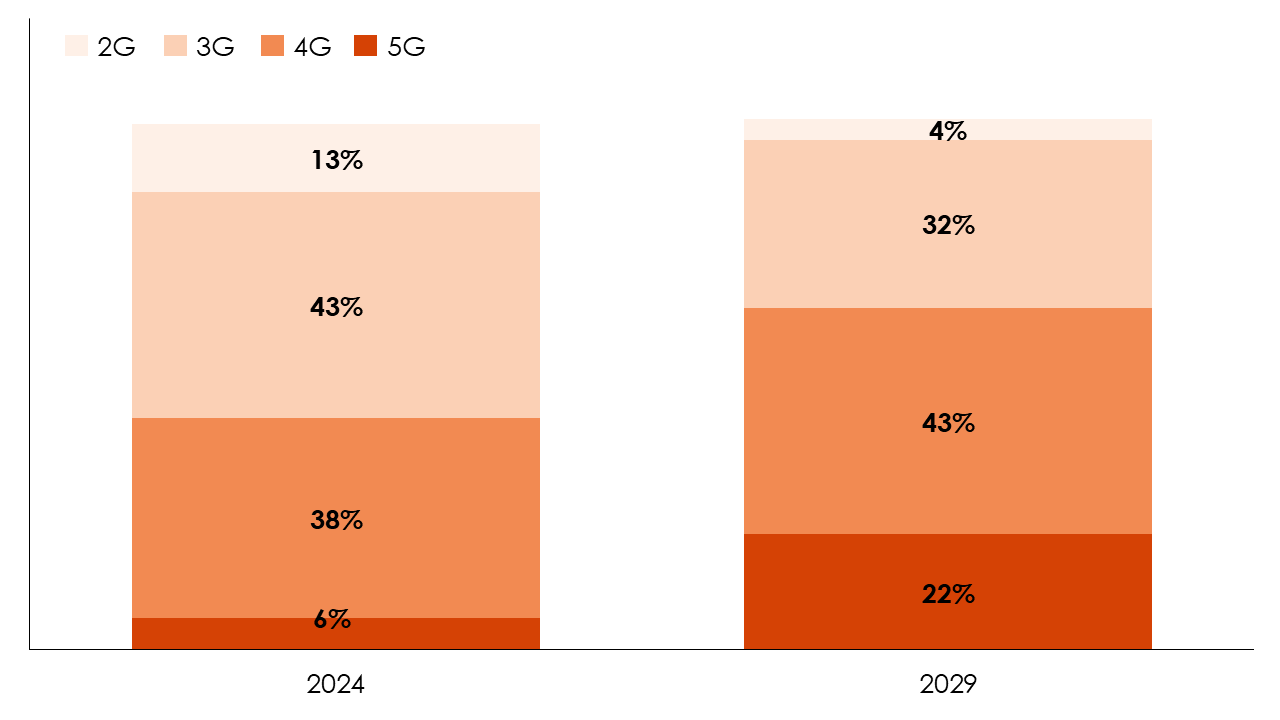

Did you know that 3G connections only overtook 2G connections in 2019 across our markets? There remains significant runway across our markets for 3G, 4G and eventually, 5G mobile infrastructure.

Advancing up the technology curve is critical: there are clear linkages between 4G development and improvements in socioeconomic development.

Technology mix across our nine markets(4)

Significant inorganic opportunity

While we currently remain focused on organic growth by adding colocations to our sites and advancing our 2.2x by 2026 strategy, there is still significant long-term potential to expand our portfolio.

In Africa and the Middle East, mobile operators still own over 70% of towers — compared to just 30% globally — representing approximately 245,000 towers. As a result, over the long term, we anticipate that operators in our regions will align with global trends by divesting their passive infrastructure assets. This shift will allow them to concentrate on core priorities such as deploying new technologies like 4G and 5G.

As mobile operators seek to drive capital and operational efficiency and divest their tower portfolios to focus on their core business, Helios Towers, with its proven operational capabilities, is a perfect partner.

(1) UN World Population Prospects (2024–2029), July 2024.

(2) Analysys Mason, February 2024. Refers to growth between 2024 and 2029.

(3) UN World Population Prospects, July 2024.

(4) GSMA Database, accessed January 2025. Weighted mobile technology mix based on FY 2024 site count.