At Helios Towers, we play a pivotal role in connecting people and enabling social and economic growth. We deliver mission-critical telecoms infrastructure and power solutions to leading mobile network operators (MNOs) across Africa and the Middle East.

Our core business — shared tower infrastructure — is inherently sustainable. By enabling faster, more efficient network rollouts, we help our customers reduce costs, expand coverage, and lower their environmental impact.

Our purpose

To connect people and power growth across Africa and the Middle East.

Our mission

To deliver customer experience excellence through our business excellence platform, creating sustainable value for our people, our environment, our customers, our communities, and our investors.

Our Vision

To be the leading mobile tower company across Africa and the Middle East.

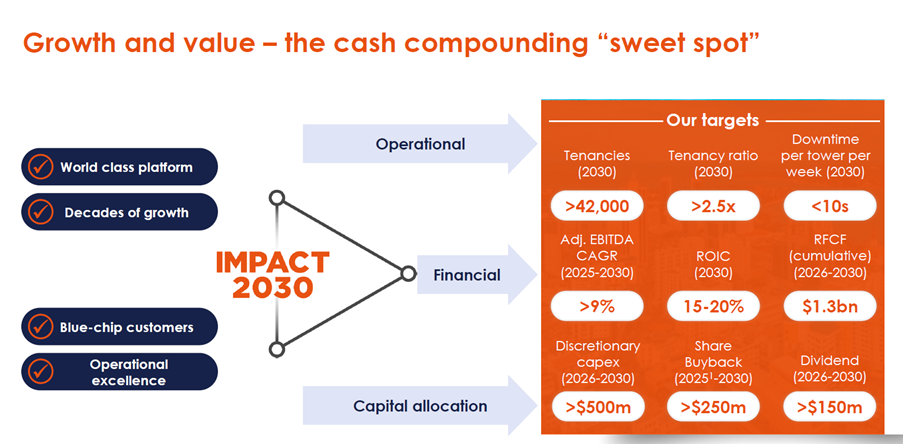

IMPACT 2030

Capital-efficient growth through tenancy expansion and customer experience excellence

Following the successful completion of two strategic cycles since our IPO — platform expansion (2019–2022) and platform integration and free cash flow generation (2022–2025) — we are now entering our next phase:

IMPACT 2030.

This strategy combines continued accretive growth with the introduction of shareholder returns, building on the early achievement of our “2.2x by 2026” target in 2025.

Through IMPACT 2030, we expect to deliver over US$1.3 billion in cumulative recurring free cash flow (2026–2030), supported by an updated capital allocation framework designed to maximise stakeholder value.

Our Track Record

We are proud of our consistent delivery:

- 10 consecutive years of USD EBITDA growth

- Business doubled in size since IPO

- Nearly 15,000 towers across nine markets

Helios Towers continues to reshape expectations of what infrastructure companies can achieve in Africa and the Middle East. We are unlocking the region’s digital potential, attracting long-term investment, and helping power the growth that connects millions more people every year.

Our ambitious but deliverable financial and operational targets